And in a nutshell, that is the sole reason for the decline in cash flow compared to its projection for the year in the prior quarter. In this quarter, the ratable component of its business increased from about 77% last year, or perhaps a bit less, in Q1, to 85% in this latest reported quarter. Cash flow is a product of many items, and in particular, a company in the midst of a transition from perpetual to ratable revenue streams, will see cash flow change in a given time period based on the level of ratable business that it closes. Cash flow the prior year had been $295 million. The company is now forecasting operating cash flow of $250 million this year, and that compares to a prior forecast of $350 million. The culprit, at least according to headlines relating to last week’s pullback, relates to weak cash flow, which fell by more than half in Q1, and did so, mainly because the decline in deferred revenues, a normal seasonal event, more than trebled.

#Splk seeking alpha full

I think it would be reasonable to imagine that full year percentage revenue growth will reach close to 30% or perhaps higher, a strong level of performance given both the size of the company, and the move to ratable consumption agreements. Revenues have been greater than forecast for every quarter for no less than 5 years. The company has actually beat its forecasts every quarter now since 2016, when its earnings just met estimates in a single quarter. It is now forecasting that it will report growth of 25% in reported revenues for the full year, compared to a prior estimate of 23%. For the full year, the company increased it revenue guidance by a bit more than the beat of Q1 and the raise of Q2. Q2 revenue expectations were increased by 1%, and margin guidance was raised nominally. The company did raise guidance-although by no great amount.

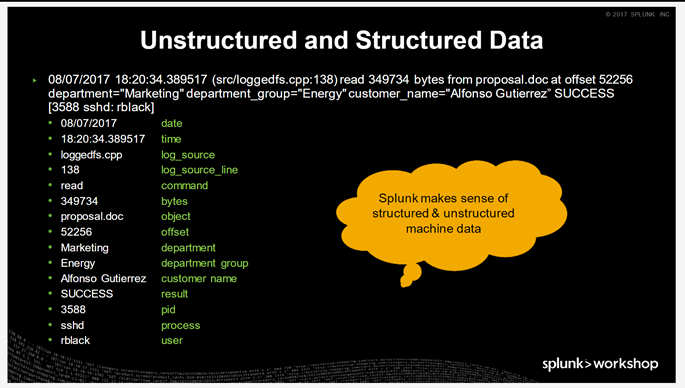

#Splk seeking alpha software

Even the reported stock based comp expense fell a little bit from 32% to 30%-although of course 30% is an outlier and far above average for even high-growth software companies. The non-GAAP operating expense ratio for the quarter was about 78%, compared to 84% in the prior year. These numbers were substantial beats-the prior consensus for revenue had been growth of 27% and the prior estimate for non-GAAP operating margins had been negative 8%.

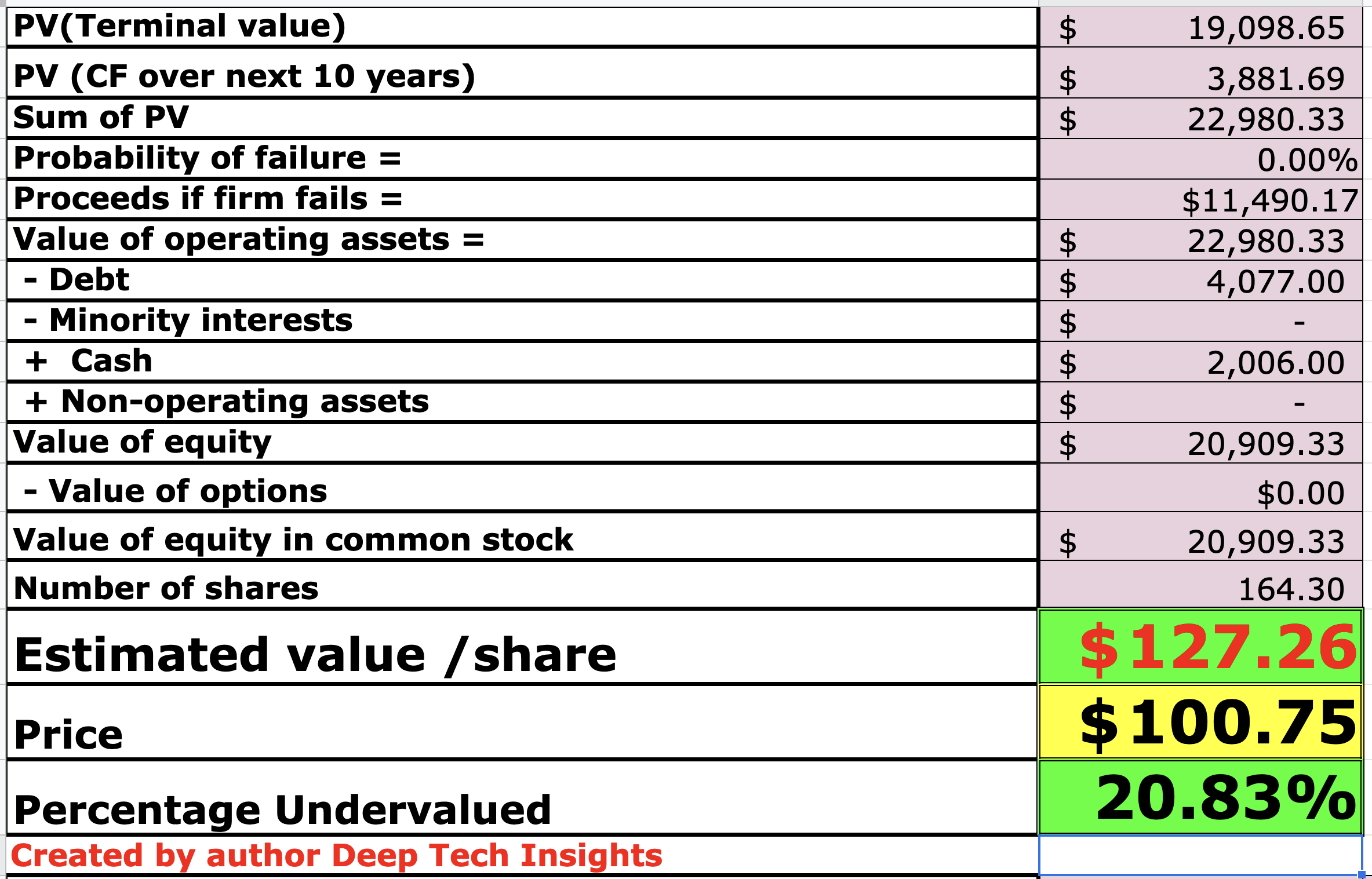

Non-GAAP gross margins for the quarter rose to almost 82% up from 79.3% in the prior year. And it reported that it non-GAAP operating margin was negative 2%. Splunk actually reported that its total revenues rose by 36%. And I expect for the shares to achieve positive Alpha and to return to relative strength over the coming year. I would be a buyer of this name at this price.

The issue with cash flow guidance is essentially meaningless and transitory. I think the company will continue to grow both its TAM and revenue and see rising profitability in years to come. I do not believe the company’s sales motion is at risk, or that its competitors-either its direct competitors or its functional alternatives are gaining ground on the company. I don’t have Splunk shares in the Ticker Target high-growth portfolio-but at this price, and this valuation, I think it makes sense for readers and subscribers to consider starting a position. But I haven’t written extensively on the name since last July when the shares were around $100. I did suggest that its valuation had started to look much more investor friendly last summer, and that its capital raise was a thing of beauty for shareholders. Is this current share price a decent entry into Splunk shares? Is something negative happening to Splunk’s positioning? Is the company’s long term growth rate materially contracting? I haven’t commented much on this name in quite some time. And Splunk, once the epitome of a highly valued enterprise IT company, has seen its valuation compress to a point where it is below average for its growth cohort.’ At this point, the shares are lower than they were at the end of last September and the one year gain of about 11% compares to a gain of the IGV of 16.5%. But apparently the results and the guidance weren’t pleasing to investors-or at least not pleasing enough-as the shares fell noticeably on Friday. Last week, Splunk ( NASDAQ: SPLK) reported what seemed like a strong quarter, and it raised guidance. Sometimes you just do not know what it is that might spook investors. Splunk-What really happened in the quarter

0 kommentar(er)

0 kommentar(er)